Home > Give > Foundation > Project Debt Elimination

Project Debt Elimination is the online process that allows individuals and/or families to work at their own pace in the privacy of their home to eliminate harmful debt from their life.

A century ago, debt was regarded as an earned privilege for a few. But today, debt is viewed as a right for all, and borrowing is an integral part of our lives. There has been a generational shift in our country. The World War II generation was savers, but later transitioned into a generation of consumers, or spenders, and today, we are a generation of debtors as we spend beyond our income using easy, yet harmful, debt (e.g., credit cards).

Scripture does not say debt is sinful, but sinful behaviors such as envy, pride, greed, gluttony, or lust – in most cases – can lead to or create debt. Make no mistake about it, God has nothing good to say about debt. The psalmist says in Psalm 37:21: “The wicked borrow and do not repay.” Solomon wrote in Proverbs 22:7: “The rich rule over the poor, and the borrower is servant to the lender.” Second Kings 4:1–7 tells the story of the widow and the oil where, because of the widow’s deceased husband’s debts, she faced losing her children to the debt collector. Fortunately, there is a positive outcome to this story, as the widow’s obedient faith and willingness to follow godly counsel led to an incredible blessing from God.

Debt extracts a physical toll. It increases stress, which contributes to mental, physical and emotional fatigue. It harms relationships and is the number-one reason for divorce in the United States. Many people raise their standard of living through debt, only to discover that the burden of debt controls their lifestyles. Debt also places the believer in financial bondage and gets in the way of our fulfilling the calling on our lives to be abundant and cheerful givers. Accumulating debt also creates a blurred line between wants and needs. Lastly, for those who have children, the question we should ask ourselves is “What lessons are we teaching our children by living in the bondage of financial debt?”

Credit cards are not inherently sinful, but they are very dangerous. Studies show that people spend about 30 percent more when they use credit cards than when they use cash, simply due to the fact that it is easier to spend money we don’t actually have. As of November 2020, the average U.S. household was carrying $6,271 in credit card debt versus $2,966 in 1992. If you cannot pay the monthly balances, you should strongly consider cutting up your card(s). Again, it’s simply too easy to spend money that you truly don’t have! Return to the days of “if you don’t have the money to buy it, go without” until you have saved for the purchase.

The dirty secret of credit cards:

Debt | Minimum Payment | Interest Rate | Years To Pay Off |

$8,000 | $160 per month ($5 per day) | 16% | 30 |

$8,000 | $300 per month ($10 per day) | 16% | 3 |

Remarkably, if a person increases the minimum payments on his or her credit cards, he or she can significantly reduce the amount of time it takes to pay off the balances. The chart above lists the same amount of debt and interest rate. The difference is in the monthly payment amount. A person with $8,000 of debt on a 16 percent interest rate can reduce 27 years of payments simply by increasing his or her minimum payments.

1. Track Expenses / Establish a Family Spending Plan

You should know exactly where your money is going, right down to the penny. A written budget helps you plan ahead and analyze spending. Having a budget will help you cut back on “impulse buying.” Every family / individual should have a spending plan.

To learn how to develop your family spending plan, click here; or consider using one of the many helpful apps to assist you in knowing where your money is going right down to the penny (e.g., mint.com or Every Dollar).

2. List Your Assets

You should list every possession you own, including your home (equity), car and furniture. You should evaluate the completed list to determine whether you should sell any assets, including downgrading your car or house, and selling your coin, gun and baseball card collections, etc. The correct attitude should be to think about how much you will gain by being out of debt rather than think about what you are losing.

3. List Your Liabilities

Most people do not know exactly how much they owe. A person should list each debt with the interest rate and minimum payment. One should also understand the need to prioritize which debts to pay back first.

4. “Rollover Your Debt” Technique Example

| Card | Min Payment | Actual Pay | 2015 | 2016 | 2017 |

| #1 Visa | $250 | $500 | PAID | ||

| #2Mastercard | $250 | $250 | $750 | PAID | |

| #3 Discover | $250 | $250 | $250 | $1,000 | PAID |

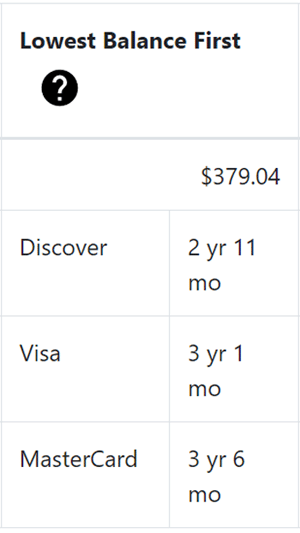

You should throw every single dime you can find at debt #1. Even if this process takes years, think of how much better off you will be in time. For most, the payment of this debt will be the single largest disposal income increase ever experienced. This is a great time to start building up short-term and long-term savings. Better yet, if you have not been able to biblically give to God what is rightfully His (the tithe) due to the bondage of debt, start now and enjoy the gift of giving. Make sure to visit powerpay.org and access its useful tool, Rollover Your Debt. This will be discussed in greater detail in the Three Action Steps to Eliminate Your Debt section.

Pay off a small debt first – it will encourage you! Next, pay off debts with higher interest rates. Once you have paid off an account, add the monthly amount from it to another debt payment. Also, you should constantly be striving to lower your interest rates; the lower the rate, the less money you will have to pay back over time. Here are some helpful tips when attempting to lower your interest rates:

a) Contact each card’s customer service number.

b) Understand that most cards have inflated interest rates because of missed/late payments. Be ready to state that you know this to be the case and share how you have been on time for X number of months.

c) Don’t take it personally if they reject this request — keep calling! Also, do not hesitate to ask to speak to a supervisor.

d) Always remain calm, friendly and professional, even if the customer service rep is harsh in dealing with you.

5. Consider Generating Additional Income

Additional income should be applied to debt elimination. But beware of protecting your relationship with your family and Lord. You can be creative, use your special talents, and do something you enjoy.

Have a garage sale. Most American homes are cluttered with material possessions that are never used or simply no longer needed. You will be amazed how much stuff you can sell to generate funds that will solely go toward paying down your debt.

6. Accumulate No New Debt

If you can’t pay for it with cash, check or debit card, then you have to go without. If you are dealing with harmful credit card debt, it is highly recommended that you cancel your cards except for one card you can keep for emergencies. Be aware that when you cancel a credit card, your credit score may decrease for a short period of time. As crazy as it sounds, the credit bureaus view it negatively when your capacity to use credit is reduced; but be assured, the best thing you can do is to stop using and depending on credit cards when making your daily purchases.

In principle, debt consolidation is a good step, given that you are working with an honorable firm, and you are committed to using only cash for ALL future purchases. A recommended nonprofit debt consolidation service is:

Consumer Credit Counseling Services 877-474-5291 / christiancreditcounselors.org

7. Be Content with What You Have

Contentment is mentioned seven times in the New Testament, and six of those passages refer to money and possessions. The apostle Paul wrote in Philippians 4:11–13, “I have learned to be content in whatever circumstances. I know what it is to be in need, and I know what it is to have plenty. I have learned the secret of being content in any and every situation, whether well fed or hungry, whether living in plenty or in want. I can do everything through him who gives me strength.” Paul learned the secret of contentment because his circumstances and accumulation of material possessions did not determine his mindset. Rather, Paul knew that true contentment was found in knowing and serving Christ, and that the Lord would provide for his needs. Society today dictates that we cannot be content unless we drive a certain car, live in a certain house, or have a certain job title. Be assured; having more will never be enough, as we will soon become dissatisfied and want the next better material possession that’s out there.

8. Consider a Radical Change in Your Life

You should lower your expenses significantly to get out of debt more quickly. Ideas include selling your home and buying a smaller one, or renting; you can also cut out all non-essentials, including cable, Internet, eating out and entertainment. Bare-bones living with no extras for a period of time will allow you to achieve your goal of debt-free living! Short-term sacrifices can turn into long-term gains if we are diligent in watching every penny we spend.

9. And Lastly … Don’t Give Up – Get Angry with Your Debt!

There will be 100 reasons for you to delay or quit your efforts. You should get angry at your debt. How many dreams have been put on hold by your debt? How many sleepless nights have you spent worrying over that debt? Use your anger to get fired up about a plan to pay off your credit card debt, once and for all! Also, don’t yield to temptation. Jesus brings freedom in all areas of our lives.

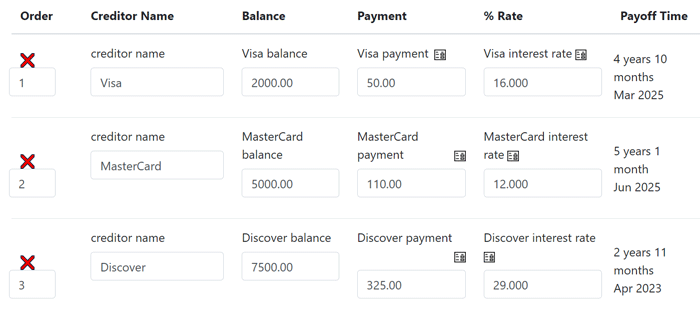

Step 1: Collect Exact Debt Details

Determine current balance owed, monthly payment amount, and interest rate.

| Creditor | Current Balance | Payment Amount | Interest Rate |

|---|---|---|---|

| Visa | $2,000 | $50 | 16% |

| MasterCard | $5,000 | $110 | 12% |

| Discover | $7,500 | $325 | 29% |

Step 2: Input Data into Payment Calculator

Go to powerpay.org to access the Payment Calculator. Please note this tool is free from PowerPay, and all information required is safe to enter as you will not be asked to share any account numbers.

Steps to access Payment Calculator:

Instructions for Payment Calculator

Step 3: Execute on Plan, and Other Helpful Information

It is imperative that you remain diligent in paying off this harmful debt. I’m sad to report that in working with couples over the years, they will stick to their debt payoff plan for a period of time only to later return to spending money they do not have. You will be faced with many hard decisions and temptations to divert from the plan, but I want to encourage you to stay the course! Harmful debt is financial bondage, and the fact of the matter is that Jesus Christ died on the Cross for us to experience freedom in all areas of our lives.

Continue to look for ways to divert money to add to your debt payoff. It’s the little things that we never think about that can add up. For example, daily Starbucks coffee, driving on the tollway, bottled water, soda, eating out, premium cable channels, etc. can add up to a lot of money quickly. Just have the mindset that every dollar you put toward paying off your debt gets you that closer to true financial freedom.

It is for freedom that Christ has set us free. Stand firm, then, and do not let yourselves be burdened again by a yoke of slavery.

Galatians 5:1

For those struggling with harmful debt, one must never forget that our God is a God of restoration. His Word (the Bible) is filled with account after account of how He restores His people. This restoration includes your finances, so don’t lose heart! And be assured that if you seek the Lord and practice sound biblical, financial principles, our gracious all-powerful God will restore!

Blessed is the man who trusts in the LORD, whose trust is the LORD. He is like a tree planted by water, that sends out its roots by the stream, and does not fear when heat comes, for its leaves remain green, and is not anxious in the year of drought, for it does not cease to bear fruit.

Jeremiah 17:7–8

As believers, we are called to give of our talents – not only financially, but also our spiritual gifting through volunteering. We have safe and secure ways to give and opportunities to bless others through legacy giving, and a myriad of volunteer opportunities.

Simple and secure. Give a single gift, or schedule recurring giving using your checking account, debit, or credit card.

Give Now

Prestonwood offers many ways to use your gifts and talents in serving others – from cameraman to choir member, technician to teacher, parking attendant to prayer warrior. Click here to find out more.

Learn More

Besides opportunities to watch services, we’re pleased to provide a variety of incredible opportunities to plug in to resources for young believers and mature Christians.

Prestonwood.Live, our online community, exists to fulfill the our mission of Prestonwood for those who cannot attend a Prestonwood campus.

Visit Prestonwood.Live

Miss a Sunday Worship Service? Want to catch up on a sermon series? Click here to see past recorded services at Prestonwood. Search for titles, filter by speaker or series, or browse by dates.

View Messages

To find out more about the ministries at Prestonwood, click on any of the links below.

Through our LifeGroup Bible Studies, small-group ministry, every person who comes to Prestonwood is provided an opportunity to build key relationships that can last a lifetime.

Find a Group

We want to help men, women and students recover from emotional, physical, relational and spiritual wounds through the power of Christ. Through classes, small groups and individual discipleship, the Life Recovery Ministry will help people pursue, overtake, and recover a life of peace and purpose.

Learn More

We are a dynamic congregation, with people from all over the North Texas region who have come together for a common purpose—to study God’s Word, to worship Him, to do His work, and to reach the world with the Gospel message.

We unapologetically value six core areas in the life of our church. Together, these shared values identify who we are, rally us toward all that we desire to accomplish, and unite us in fellowship.

Learn More

The most important decision in your life will be whether you accept Jesus Christ as your personal Lord and Savior.

Learn More

No matter which campus you attend, you’ll find warm smiles to greet you; vibrant, worshipful music to lift your soul; and powerful teaching from God’s Word that will transform your life.

You’ll feel welcome from the very beginning of your visit to Prestonwood. We have something for everyone in your family so let us help you plan your first visit.

Plan Your Visit

This class serves as the centerpiece for helping new members and those considering Prestonwood plug in to the life and ministries of our church.

More Information